Correlating Stock Returns Using Python

Learn how to pull stock price data with Python and analyze correlations between different companies' stock returns using a Seaborn heatmap.

In this tutorial I'll walk you through a simple methodology to correlate various stocks against each other. We'll grab the prices of the selected stocks using python, drop them into a clean dataframe, run a correlation, and visualize our results.

(1) Import libraries, select our list of stocks to correlate

import numpy as np

import pandas as pd

#used to grab the stock prices, with yahoo

import pandas_datareader as web

from datetime import datetime

#to visualize the results

import matplotlib.pyplot as plt

import seaborn

#select start date for correlation window as well as list of tickers

start = datetime(2017, 1, 1)

symbols_list = ['AAPL', 'F', 'TWTR', 'FB', 'AAL', 'AMZN', 'GOOGL', 'GE']

(2) Pull stock prices, push into clean dataframe

#array to store prices

symbols=[]

#pull price using iex for each symbol in list defined above

for ticker in symbols_list:

r = web.DataReader(ticker, 'yahoo', start)

# add a symbol column

r['Symbol'] = ticker

symbols.append(r)

# concatenate into df

df = pd.concat(symbols)

df = df.reset_index()

df = df[['Date', 'Close', 'Symbol']]

df.head()

We're now left with a table in this format:

| date | close | symbol |

|---|---|---|

| 2017-01-03 | 113.4101 | AAPL |

| 2017-01-04 | 113.2832 | AAPL |

| 2017-01-05 | 113.8593 | AAPL |

3) However, we want our symbols represented as columns so we'll have to pivot the dataframe:

df_pivot = df.pivot('date','symbol','close').reset_index()

df_pivot.head()

| date | AAL | AAPL | AMZN | F | FB | GE | GOOGL | TWTR | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2017-01-03 | 45.7092 | 113.4101 | 753.67 | 11.4841 | 116.86 | 30.1370 | 808.01 | 16.44 |

| 1 | 2017-01-04 | 46.1041 | 113.2832 | 757.18 | 12.0132 | 118.69 | 30.1465 | 807.77 | 16.86 |

| 2 | 2017-01-05 | 45.3044 | 113.8593 | 780.45 | 11.6483 | 120.67 | 29.9754 | 813.02 | 17.09 |

| 3 | 2017-01-06 | 45.6203 | 115.1286 | 795.99 | 11.6392 | 123.41 | 30.0610 | 825.21 | 17.17 |

| 4 | 2017-01-09 | 46.4792 | 116.1832 | 796.92 | 11.5206 | 124.90 | 29.9183 | 827.18 | 17.50 |

(4) Next, we can run the correlation. Using the Pandas 'corr' function to compute the Pearson correlation coeffecient between each pair of equities

corr_df = df_pivot.corr(method='pearson')

#reset symbol as index (rather than 0-X)

corr_df.head().reset_index()

del corr_df.index.name

corr_df.head(10)

| symbol | AAL | AAPL | AMZN | F | FB | GE | GOOGL | TWTR |

|---|---|---|---|---|---|---|---|---|

| AAL | 1.000000 | 0.235239 | 0.226061 | 0.068024 | 0.356063 | -0.332681 | 0.494075 | 0.169487 |

| AAPL | 0.235239 | 1.000000 | 0.868763 | 0.184501 | 0.911380 | -0.895210 | 0.903191 | 0.781755 |

| AMZN | 0.226061 | 0.868763 | 1.000000 | 0.108351 | 0.744732 | -0.937415 | 0.864455 | 0.955373 |

| F | 0.068024 | 0.184501 | 0.108351 | 1.000000 | 0.206055 | -0.216064 | 0.189753 | 0.161078 |

| FB | 0.356063 | 0.911380 | 0.744732 | 0.206055 | 1.000000 | -0.814703 | 0.900033 | 0.650404 |

| GE | -0.332681 | -0.895210 | -0.937415 | -0.216064 | -0.814703 | 1.000000 | -0.882526 | -0.866871 |

| GOOGL | 0.494075 | 0.903191 | 0.864455 | 0.189753 | 0.900033 | -0.882526 | 1.000000 | 0.789379 |

| TWTR | 0.169487 | 0.781755 | 0.955373 | 0.161078 | 0.650404 | -0.866871 | 0.789379 | 1.000000 |

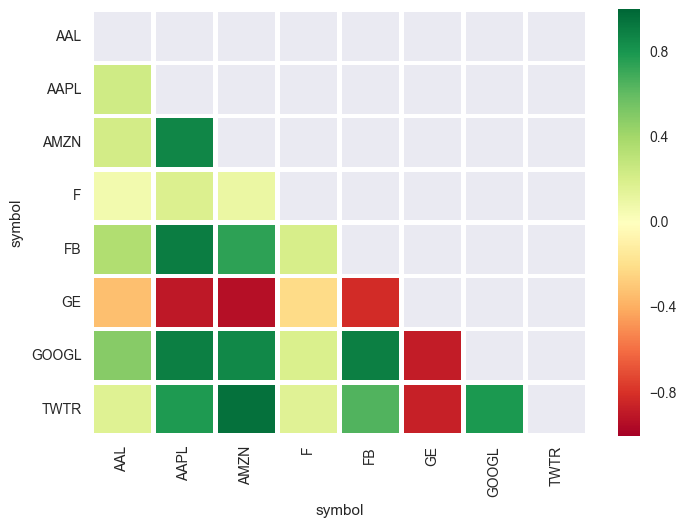

5) Finally, we can plot a heatmap of the correlations (with Seaborn and Matplotlib) to better visualize the results:

#take the bottom triangle since it repeats itself

mask = np.zeros_like(corr_df)

mask[np.triu_indices_from(mask)] = True

#generate plot

seaborn.heatmap(corr_df, cmap='RdYlGn', vmax=1.0, vmin=-1.0 , mask = mask, linewidths=2.5)

plt.yticks(rotation=0)

plt.xticks(rotation=90)

plt.show()

Here we can see that, as expected, the tech companies are generally pretty highly correlated (as indicated by dark green -- AMZN/GOOGL, FB/AAPL, etc). Conversely, Ford (F) and General Electric (GE) are either not correlated or negatively correlated with the rest of the group.