On Average, Forgoing College in Favor of Entering the Workforce + Investing Tuition Costs Nets Higher Returns

A financial comparison of the return on investment (ROI) from attending college versus skipping college, entering the workforce, and investing tuition in the stock market.

College is obviously expensive, but is it still a wise investment?

We've all heard how expensive college is getting, along with plenty of criticism surrounding its value in a changing job market. Of course, there are many benefits beyond the monetary ones that should be considered when exploring college options, but for the purpose of this post I'm going to limit the scope and purely assess the financial benefit of attending college.

The main financial benefit of attending college is the earnings differential received by a college graduate over a high school graduate; Payscale provides 20-year return on investment (ROI) figures for exactly that. The website compares the gain in median pay from graduating over a high school graduate across ~1,250 4 and 5-year educational institutions in the United States.

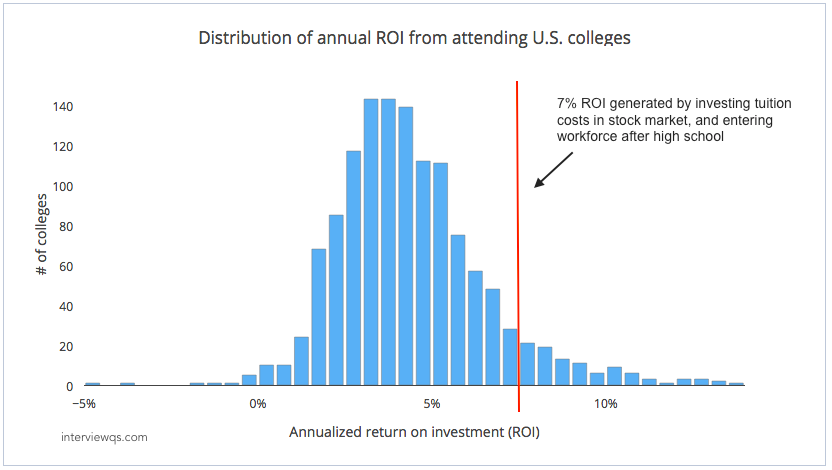

Below I'll compare the ROI of college to the return generated from simply joining the workforce after high school, but investing college tuition costs* into the stock market (using S&P 500 as a proxy).

Option A - Skip college, enter workforce, and invest your saved tuition costs

Lets say we skip college and dump our saved money from avoided tuition costs into the stock market. The S&P 500 (our stock market proxy) has risen from ~435 at the beginning of 1993 to ~2,260 at the beginning of 2017. This represents a 520% return, which equates to an annualized return of ~7.1%** for 24 years. Note that we get 24 years for our investment return, rather than the 20 years college gets, since we can make our investment upon high school graduation and immediately realize returns.

Option B - Attend college, pay tuition, generate higher levels of income if you graduate

Here, we'll attend college as usual, and realize the average ROI across U.S. colleges. Using our Payscale ROI data mentioned above, and normalizing for graduation rates (ROIgraduation rate = Expected ROI), the average annualized ROI with financial aid is ~4.5%* (median 4.1%).

The winner?

As shown, on average, forgoing college costs, investing that money in equities, and beginning work would generate significantly higher returns than going to college. Below you can see the distribution of ROI across U.S. colleges, along with our 'Option A' comparison point.

A couple of additional stats:

- Only ~10% of the ~1250 colleges listed on Payscale generate an average ROI higher than the 7.1% generated by foregoing college and investing that money. In other words, a student planning on enrolling in college would generate higher returns entering the labor force and investing tuition into the stock market 90% of the time.

- If we remove financial aid, only ~2.5% of colleges generate a better ROI than our 'skip college invest in stock market' option!

Footnotes/disclaimers:

- Of course, lenders won't give out large loans for an individual to skip college and dump tuition into the stock market, this is just a hypothetical scenario.

- One could incorporate undergraduate population size of each school to volume-weight the ROIs provided by Payscale, for an improved average across the pool. (I did not feel like scraping undergrad population size for all schools listed).

- Returns vary significantly by school and major. If you're trying to decide whether or not to attend college from a financial point of view, I'd recommend being thoughtful about your school choice, major, potential financial aid, and ability to graduate enrolled with a degree from said school in said major. As mentioned above, there are also many additional (non-financial) factors to consider.

- I went to college, and would recommend it.